Tax-Free Capital Gains: How Non-Residents Can Protect Most of their Property Profits from Tax: Amazon.co.uk: Bayley, Carl: 9781907302954: Books

The Spanish Capital Gains Tax Trap – When to sell your UK home and whens best to move to Spain | Upsticks Spain

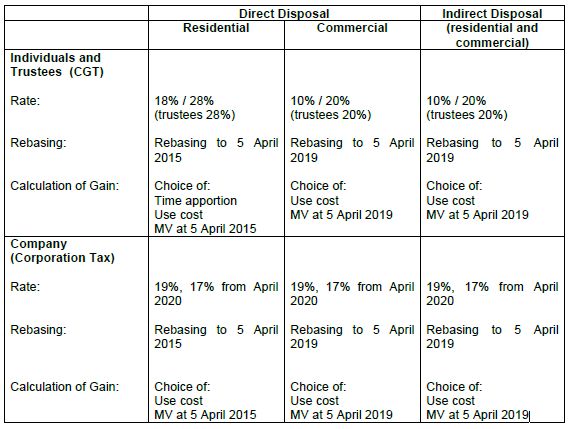

Non-UK Residents Selling UK Property: 3 Ways to Work Out Your Gain for Capital Gains Tax - Inca Caring Accounting